Arbitrator Registry and Application

ONLINE PROPERTY TAX ARBITRATION SYSTEM - AVAILABLE NOW

Visit Texas.gov/propertytaxarbitration for more information and to apply to join the arbitrator registry.

All arbitrators are required to use the online arbitration system.

Arbitrators desiring to be included on the Arbitrator Registry must apply using the online arbitration system.

The Comptroller’s office is required to maintain a registry of qualified individuals who have agreed to serve as arbitrators to hear arbitration cases requested under Tax Code Chapter 41A. Property owners have the option to request regular binding arbitration (RBA) as an alternative to filing an appeal of an appraisal review board (ARB) decision to district court and limited binding arbitration (LBA) to compel the ARB or chief appraiser to comply with certain procedural requirements relating to protests.

Arbitrators work as independent, neutral parties to hear and examine the facts of a case and make a decision that is binding on all parties.

To apply to be on the arbitrator registry, you must meet the statutory requirements listed below.

Arbitrators must conduct arbitrations according to Tax Code Chapter 41A, Comptroller Rules and all applicable laws.

Arbitrator Application and Requirements

To be listed on the registry, arbitrators must:

- Principally reside in the state of Texas

- Meet the following license and training requirements:

- Real estate broker or salesperson

- Real estate appraiser licensed

- Certified public accountant

- PTAD Arbitrator course modules on property tax law and ARB training modules

- Thirty (30) hours of training on arbitration and alternative dispute resolution procedures. Course must be taken from a college, university, legal trade association or real estate trade association.

- Agree to conduct the arbitration for the allowed fee schedule

- Complete an online arbitrator registry application

| Prerequisites | Licensed Professionals | Attorneys |

|---|---|---|

| Texas License Type | Attorney licensed by the state of Texas | |

| License Status | Continuous active status for 5 years | Active in good standing |

| Training Requirements | PTAD Arbitrator course modules on property tax law and ARB training modules |

Arbitrator Training

Tax Code Section 41A.06 requires persons seeking to become arbitrators to complete:

- Thirty hours of training on arbitration and alternative dispute resolution procedures

- Receive training from a college, university, legal trade association or real estate trade association. The Comptroller's office does not make recommendations for specific training providers or courses.

- Does not apply to attorneys seeking to become arbitrators.

- Comptroller trainings do NOT count toward the required 30 hours of training listed above.

- The Comptroller’s four-hour training series on property tax law

- The Comptroller’s training modules established for ARB members

Comptroller trainings are available in the online Property Tax Assistance Division (PTAD) Learning Portal in the following variations:

- PTAD Comprehensive Arbitrator Training Series

Enroll in this course to complete ALL required modules: - Arbitrator Module 1: Introduction, LBA, RBA and Arbitrator Hearing and Determination

- Arbitrator Module 2: Prohibited Communication and Appraisal

- Arbitrator Module 3: Where to Find it in the Law

- Arbitrator Module 4: Registry, Ethics, Customer Service and Appendices

- ARB Module 1: New Member ARB Training

- ARB Module 2: ARB Continuing Education Training

- PTAD Arbitrator Training Modules

Enroll in this course if you ONLY need to complete the four Arbitrator training modules. - PTAD ARB Training Modules for Arbitrators

Enroll in this course if you ONLY need to complete PTAD's ARB training modules.

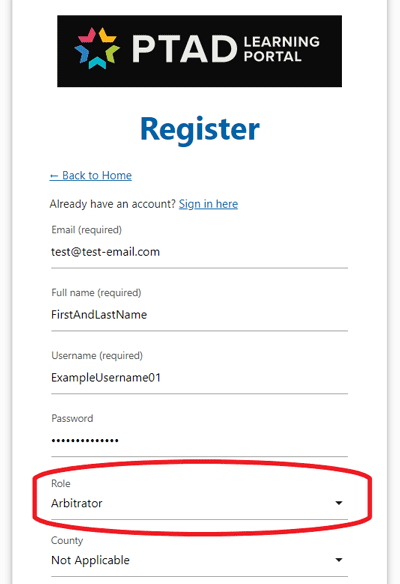

When registering for a new account in the new PTAD Learning Portal, current and prospective arbitrators must select Arbitrator from the role dropdown.

The PTAD Learning Portal does NOT automatically report your course completion to the Arbitration team. Upload your completion certificate in the online arbitration system as part of your application.

Contact the Arbitration team at ptad.arbitration@cpa.texas.gov or 800-252-9121 for more information about this training.

Regular Binding Arbitration

Arbitrators may be appointed to RBA cases. Property owners who are dissatisfied with the ARB’s findings in some cases have the right to appeal the ARB’s decision. Visit the RBA webpage for more information.

Limited Binding Arbitration

Arbitrators who are licensed attorneys may be appointed to LBA cases. Property owners who believe the ARB or chief appraiser failed to comply with a procedural requirement have the right to request an arbitrator review their claim in a LBA. These are appeals dealing with procedural requirements, not value. Visit the LBA webpage for more information.

Updating Registry Information

Arbitrators are required to update their information in the online arbitration system within 10 calendar days concerning changes to any of the following:

- arbitrator qualifications;

- eligibility to serve in specific counties;

- contact information; or

- any material change regarding information provided in the arbitrator's registry application.

Arbitrators who are currently on the Arbitrator Registry can make changes to their information in the online arbitration system

Disciplinary Action

The Comptroller's office may remove an arbitrator from the registry if.

Disciplinary Discretion

The Comptroller may take appropriate disciplinary action where there is clear and convincing evidecne of a violation, even if that violation does not rise to the level of good cause for removal. Good cause for disciplinary action includes when an arbitrator:- is not qualified or becomes unqualified;

- fails to respond to or refuses to comply with communications and requests from the Comptroller's office by the established deadline; or

- has violated one or more Comptroller Rules.

Grounds for Removal

Good cause for removal includes when an arbitrator:

- fails or declines to renew the agreement to serve as an arbitrator;

- is not qualified or becomes unqualified;

- is not eligible or becomes ineligible;

- fails to respond or refuses to comply with Comptroller requests for information;

- violated one or more provisions of Comptroller Rules relating to Arbitration Proceedings or Arbitrator Responsibility for Registry Profile.

- engaged in repeated instances of bias or misconduct while acting as an arbitrator;

- engaged in fraudulent conduct; or

- engaged in the type or nature of the conduct that the Comptroller determines would not be in the best interest of impartial arbitration proceedings.

Complaints

A person may file a complaint against a registered arbitrator within 60 calendar days of the last incident giving rise to the request. The complaint must include the following:

- a letter addressed to the PTAD director, Shannon Murphy, and signed by the complainant, that identifies the arbitrator and the Comptroller Rule 9.4265 grounds that constitute good cause for disciplinary action;

- at least one sworn statement from an individual with first-hand knowledge of the misconduct that includes detailed facts supporting the grounds for disciplinary action; and

- copies of all available communications exchanged between the arbitrator and the parties.

Requests for removal should be sent to:

Property Tax Assistance Division

Texas Comptroller of Public Accounts

P.O. Box 13528

Austin, Texas 78711

Rules

Division 1 – General Rules

- §9.4201 Scope and Construction of Rules; Computation of Time

- §9.4202 Definitions

- §9.4203 Prohibited Communications Regarding Pending Arbitrations

- §9.4204 Filing Requests for Binding Arbitration and Deposit Payments

- §9.4205 Agent Representation in Binding Arbitration

- §9.4206 Appraisal District Responsibility for Processing Request

- §9.4207 Comptroller Processing of Request

- §9.4208 Withdrawing a Request

- §9.4209 Refund and Arbitrator Fee Processing

- §9.4210 Forms

- Form AP-219, Property Owner Request for Regular Binding Arbitration (PDF)

- §9.4211 Communication with Property Owner, Property Owner's Agent, ARB, Appraisal District and Arbitrator

- §9.4212 Arbitration Proceedings

- §9.4213 Substitution of Arbitrator Assigned to Arbitration Hearing

Division 2 – Limited Binding Arbitration for Procedural Violations

- §9.4220 Request for LBA,

- §9.4221 LBA Deposit

- §9.4222 Comptroller Appointment of Arbitrators for LBA

- §9.4223 Dismissal for Lack of Jurisdiction

- §9.4224 LBA Award

- §9.4225 Correction of Procedural Violations

- §9.4226 Payment of Arbitrator Fees

Division 3 – Regular Binding Arbitration of Appraisal Review Board Determinations

- §9.4240 Request for RBA

- §9.4241 RBA Deposit

- §9.4242 RBA 45-Day Settlement Period

- §9.4243 Comptroller Appointment of Arbitrators for RBA

- §9.4244 Dismissals for Lack of Jurisdiction

- §9.4245 RBA Award

- §9.4246 Correction of Appraisal Roll

- §9.4247 Payment of Arbitrator Fees

Division 4 – Comptroller’s Registry of Arbitrator’s